The 56th meeting of the Goods and Services Tax Council announced the implementation of a new tax regime, GST 2.0, the most-awaited financial decision ever. The Council believes that the simplified structure of the new GST regime 2025 can bring about significant changes by easing compliance, boosting economic growth, and primarily reducing tax disputes.

But even after the successful GST council meeting, the question remains the same: how new GST rates impact India’s import and export businesses? Is it going to be a big win for Indian businesses or a slam to the entire financial ecosystem of Indian traders? Here is the complete GST Council meeting update.

Next Gen GST Reforms 2025: Understand the Complete Slab

Earlier, the complete slab of GST was divided into four slabs, which were 5%, 12%, 18%, and 28%, often creating confusion scenarios among people while dealing with GST classification status and handling compliance.

However, the new GST Reform 2025 has just changed the 4-slab system to a 3-tier GST rate system, effective as of 22nd September 2025.

- 5% GST – This slab includes essential food items, medicine, packaged food items, and personal care products.

- 18% GST – This Tier includes electronic items, consumer durables, professional services, and small cars and textiles.

- 40% GST – This tier includes all luxury and sin goods, such as premium cars, alcohol, tobacco, and even casino services.

The 56th GST Council meeting press release stated that the complete GST tier system implemented will help in reducing inflation, which is estimated to be 1.1 percentage points. They added, “It will help businesses to deal with compliance more easily across every sector.

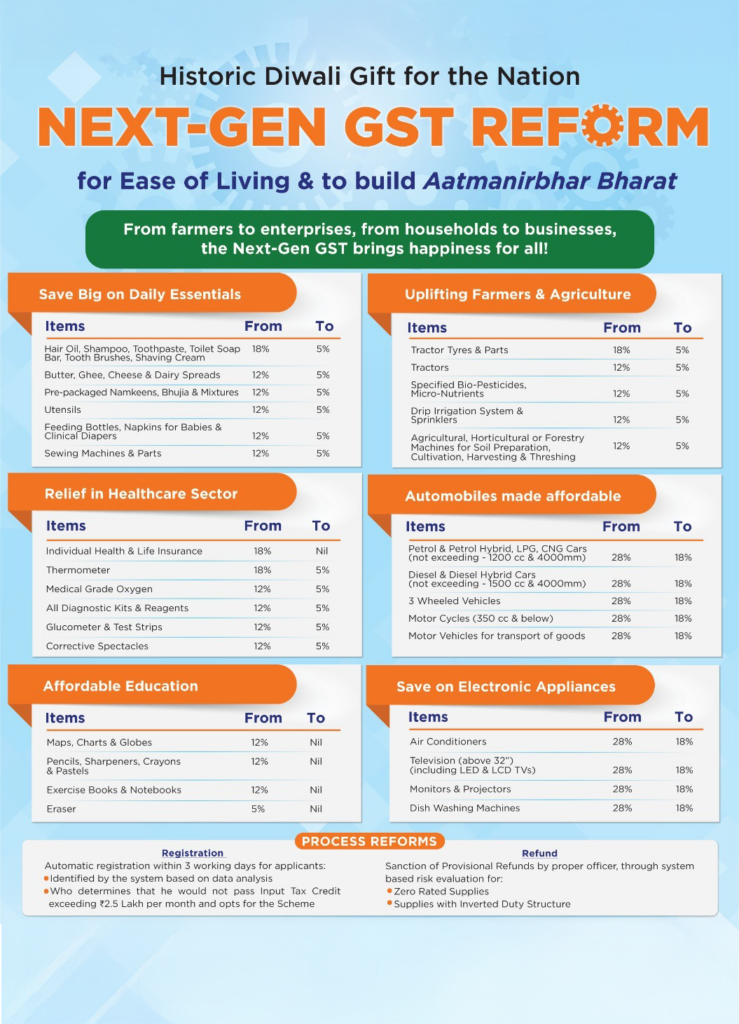

The updated GST rate structure for some of the commonly used consumer products is shown below as announced by the GOI.

Complete List of Revised GST Rates on Select Items

GST on Essential and Food Products

| Items/products | Old GST rate % | New GST rate % |

| Paneer, Roti, UHT milk, Khakhra | 5% | 0% |

| Condensed milk, Butter, clarified butter (Ghee), Cheese | 12-18% | 5% |

| Chocolates, Baked food products, Pasta | 12-18% | 5% |

| Sugar products, Dry fruits | 12-18% | 5% |

GST on Beverages and Sin Goods

| Items/products | Old GST rate % | New GST rate % |

| Soya Milk, Sugar drinks, packaged coconut water | 18-28% | 40% |

| Bidis | 28% | 40% |

| Tobacco products, pan Masala, and Cigarettes | 28% | 18% |

GST Rate Change on Industrial and Construction Goods

| Items/products | Old GST rate % | New GST rate % |

| Cement | 28% | 18% |

| Coal, peat, and Lignite | 5% | 18% |

GST Rates on Healthcare and Medical Supplies

| Items/products | Old GST rate % | New GST rate % |

| Essential drugs, diagnostic kits, and medical oxygen | 12-18% | 5% |

| Life-saving drugs | 12% | 0% |

| Homeopathic medicines, Ayurveda, and Unani | 12% | 5% |

| Veterinary and dental devices | 18% | 5% |

Revised GST Rates on Education and Stationery Items

| Items/products | Old GST rate % | New GST rate % |

| Pencil, eraser, exercise, Crayons, sharpeners | 12% | 0% |

| School trays and geometry boxes | 12% | 5% |

New GST Rates on Automobiles and Agricultural Machinery

| Items/products | Old GST rate % | New GST rate % |

| Motorbikes (less than 350 CC), scooters, and small cars | 28% | 18% |

| Small cars with less than 1200CC petrol or less than 1500CC for diesel, and overall, less than 4 meters | 28% | 18% |

| Large cars and the luxury segment | 28% | 40% |

| Tractors less than 1800 CC | 12% | 5% |

| Tractors greater than 1800 CC | 28% | 18% |

| Tractor parts | 18% | 5% |

| Buses with more than 10 seats (commercial purpose) | 28% | 18% |

| Automotive parts | 28% | 18% |

GST Rate Cuts on Electronic Appliances

| Items/products | Old GST rate % | New GST rate % |

| TVs (≤ 32 inch) | 28% | 18% |

| Air conditioner (AC) | 28% | 18% |

| Dishwasher | 28% | 18% |

| Monitors | 28% | 18% |

| Projectors | 28% | 18% |

| Refrigerators | 28% | 18% |

| Washing machines | 28% | 18% |

| Laptops | 28% | 18% |

GST on Services, Entertainment, And Insurance

| Items/products | Old GST rate % | New GST rate % |

| Life and health insurance | 18% | 0% |

| Cinema tickets (less than Rs 100) | 12% | 5% |

| Cinema tickets (more than Rs 100) | 28% | 18% |

| Private tuition, vocational courses, and charitable hospitals | 12% | 18% |

| Home stays | 12% | 5% |

| Yoga services and Gyms | 18% | 5% |

| Apparel | 12% | 18% |

Next Gen GST and Export Business: What’s The Change?

Check out the key implementation for the Export business:

- Improved cash flow

A major reduction of GST rates on manufacturing and essential items will lower the burden on exporters, as GST 2.0 reduces the production cost and provides a much easier refund mechanism.

- Enhanced Compliance

Earlier, it was tricky and daunting to specify every tax input from the 4-slab tax system. But now, Exporters can simplify GST rates by focusing on two major streams of next-gen GST reform (5% and 18%) while enhancing the tracking process of ITC and filing returns, implementing time-saving structures.

- Global Competitiveness

Since it lowers the tax cost input, it increases competitiveness in the global market. Taking the example of textile exporters, the complete slab of yarn and fabric falls under the 18% tax category, which means overseas importers will find the lower price more attractive, resulting in an overall improvement in the export business.

New GST Rates and Import Business: Neutral Outcomes?

Go through the new tax regime 2025 impacts on the Import businesses:

- Lower Rates on General Goods

Earlier, most goods used to fall into the categories of 28% and 12%, which have been completely realigned into one category, 18%. Which means, electronic components and small machinery are now much easier and cheaper to import, elevating the global supply chain efficiency.

- Alignment With the Domestic Market

As the New GST rates are significantly aligned with the domestic goods, they generate less tax distortion. This scenario will increase the level of the playing field between foreign suppliers and local manufacturers.

- ITC Advantages

The opportunity of claiming IGST as ITC will remain the same for importers. This will keep the cost in check and assures that the tax doesn’t cascade completely.

What Can Be the Challenges for Importers After the New GST Rate List?

As we can experience mixed views on the New GST rate list for importers, here we can see some challenges faced by them:

- Upfront Cash Flow Pressure

Importers are required to pay an upfront amount even after IGST is recoverable. This can put pressure on the working capital of the business, especially those who rely mostly on overall import business and bulk imports. In such a scenario, the Businesses can collaborate with an import factoring company like Credlix to avoid cash flow pressure.

- Luxury Goods on A Higher Slab

According to the new tax regime 2025, the 40% tax slab is for luxury products like premium cars, high-end electronic gadgets, and sin goods like tobacco, cigarettes, and many more. This can impact the business with slimmer margins.

- Custom duty + GST impact

Even after GST slabs have been revised and lowered, and if customs duty remains the same, it doesn’t impact the import and landed cost, and will remain on the higher side.

Wrapping up!

The implementation of new GST rates in India has been a bold move by the Indian government at the 56th meeting of the Goods and Services Tax Council. This has been a vital step towards many import and export businesses. For exporters, the next-gen GST reform 2025 has made refunds easy, compliance, and strengthened the overall position of Indian global suppliers. Whereas for the Import sector, it has been a neutral game, where general goods have become cheaper, but luxury products are marked at a 40% GST rate.

However, if Indian exporters and importers still find it challenging to fetch out GST rates for specific products, they can simply search HSN codes here. HSN codes can simplify the GST norms and codes for specific products, particularly when trading with other countries.

Overall, GST 2.0 is going to help the growth-driven sectors, and it might impact the non-essential imports. The final recommendation for businesses is to quickly adapt their pricing structure and compliance system, and even their supply chain, which can make them winners in the whole landscape of the new tax regime 2025.

Frequently Asked Questions

Q1: Which items are being exempted from GST?

- Food and agricultural products (except packaged and branded food)

- Healthcare services

- Education services (except coaching centers and private training institutes)

- Financial and social services

- Health insurance and Life insurance premiums

Q2: Which items have moved under the 40% GST slab?

- Tobacco and sin goods: Pan masala, gutka, chewing tobacco, cigarettes, cigars, and unmanufactured tobacco.

- Luxury vehicles: Large cars (petrol >1200 cc or diesel >1500 cc; length >4 m), Motorcycles over 350 cc, Yachts and private aircraft/helicopters.

- Aerated, sugary, carbonated, caffeinated non-alcoholic beverages.

Q3: When are the new GST rates coming into effect?

GOI has announced the implementation of revised GST rates from 22nd September 2025